E-Commerce Markets Across ASEAN

By Matthew Zito, Dezan Shira & Associates

Singapore, Malaysia, Indonesia, and the Philippines are quickly becoming four of the hottest e-commerce markets in ASEAN. While online shopping is experiencing a meteoric rise in all four countries, their respective regulatory environments, cultural and linguistic make-ups, and states of infrastructure development lead to some important differences to take note of.

Payment systems are by far the most common impediment to e-commerce growth across all four markets, primarily owing to underdeveloped credit and debit card use typical of Asia more widely. The next most prevalent obstacle is internet access, which may be broken down into basic access and internet speed. While the former is spreading to every corner of ASEAN via low-price smartphones, the latter has some catching up to do before the e-commerce market can reach its full potential. The timely removal of these obstacles will strongly determine the future of the industry in ASEAN.

Singapore: Low Barriers to Cross-Border Sales

Singapore’s online shopping market has undergone explosive growth in the past four years, from S$1.1 billion (US$881 million) in 2010 to a forecasted S$4.4 billion (US$3.5 billion) in 2015. An estimated 40 percent of total sales come from domestic websites, which dominate in sales of events tickets and insurance. Singapore is also home to a vibrant community of homegrown e-commerce start-ups through cross-border sales remain strong in the entertainment and publishing industries (books, movies, music, and video games).

Mobile shopping, while common among high-income shoppers, still has significant potential for growth, contingent upon improvements to Singapore’s mobile broadband network. The country’s well-known treaty network and low corruption levels allow for particularly profitable crossborder trade, with goods valued below US$320 shipped duty-free. Notable retailers in the city-state include Reebonz (luxury products and services, e.g. high-end handbags, and luxury travel packages), Redmart (household items, groceries), and Luxola (cosmetics).

Malaysia: Diverse Consumer Base

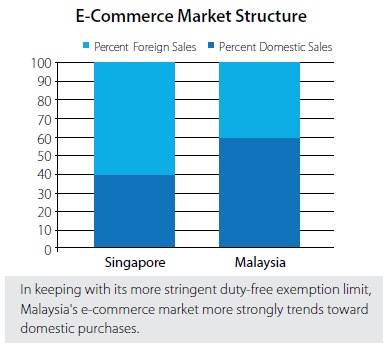

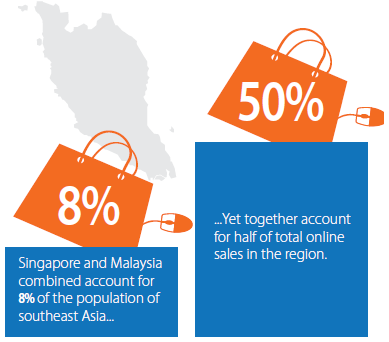

Along with Singapore, Malaysia dominates the Southeast Asian e-commerce market. Despite the small size of their populations relative to the region (only 8 percent combined), the two countries account for half of total online sales in ASEAN. Malaysian consumers display a moderate preference for cross-border online shopping—this constitutes an estimated 40 percent of all online transactions, primarily from Chinese and American retailers.

Growth in Malaysia’s e-commerce market has been fueled by the country’s up-and-coming middle class. Online travel in particular, through retailers like AirAsia.com, has witnessed a boom in sales, which in the Malaysian market alone totaled US$90.8 billion in 2013.

Compared with Singapore, however, goods imported into Malaysia are taxed more heavily and must comply with more stringent regulations (e.g. the duty-free limit is set at US$160). And while Malaysia’s much larger and younger population as compared to Singapore highlights its future potential as an e-commerce market, website localization may be more difficult owing to the country’s linguistic and cultural diversity.

Indonesia: Urbanites Drive Growth

Illustrating the rise of e-commerce in Indonesia, annual online sales are forecasted to grow from US$1 billion-$3 billion in 2014 and reach US$10 billion by the end of 2015. With its population of nearly 10 million and relatively well-developed network infrastructure, the capital, Jakarta, led initial growth in the market; recently, however, orders from outside the country’s capital have begun to swell, hinting at big opportunities for growth in second and third-tier cities.

Indonesia’s online shopping industry is hindered by the country’s current state of internet infrastructure, which renders home internet access slow and expensive. Accordingly, the majority of online purchases are made during office hours, when a growing number of white-collar workers are able to use their company PCs to make purchases.

Indonesia’s inefficient transportation channels present a double-edged sword to online retailers. On the one hand, this makes online shopping more attractive to urban dwellers and far-flung rural residents, while on the other, the delivery of goods suffers on account of faulty maps, unclear addresses and unreliable courier service.

The Philippines: Powered by Connectivity

The Philippines stands out from other ASEAN countries for its sheer number of internet users – an estimated 35 million – making it the largest English-language online market in Southeast Asia. This also means that foreign online retailers have less work to do in adapting their websites to the local market. For example, despite having no local presence, Amazon ranks as one of the top 20 most visited sites among Filipinos. Filipinos are also the biggest users of social media worldwide and the penetration of Facebook in particular is second to none.

Characteristics of the Filipino economy present an especially lucrative market for online sales— in contrast with the export-driven economies of much of Asia, over 70 percent of the Philippines’ GDP comes from consumption. The Philippines performs considerably well in terms of logistics, where foreign companies such as FedEx and DHL have brought down prices and streamlined the delivery of consumer goods. Considerations such as these should play a central role in foreign investors’ strategic planning for entry into the country’s e-commerce market.

Notable retailers include Sulit.com.ph (a classifieds site where payment is arranged directly between the buyer and seller), AyosDito (a competing classifieds site), Lazada (consumer electronics, home and living, clothing, and accessories), Cebu Pacific (low-cost airline tickets), and Hallo Hallo Mall (a classifieds-style site with its own online payment system).

As evidenced by this list, payment systems remain a problem in the Philippines. This is gradually improving, however, with the spread of ATM machines, direct debit, prepaid cards, and even cash-on-delivery options. This will help move more of the market away from individual buyer-to-seller sales and toward larger centralized retailers.

This article is an excerpt from the May 2014 edition of Asia Briefing Magazine, titled “E-Commerce Across Asia: Trends and Developments 2014.” In this issue, we provide a comprehensive overview of e-commerce trends across the Asia-Pacific region with a focus on developing markets in Southeast Asia. In addition to analyzing macro-level economic and development indicators that signal the potential for region-wide growth, we explore several rapidly growing markets in-depth while highlighting opportunities for investment in each.

This article is an excerpt from the May 2014 edition of Asia Briefing Magazine, titled “E-Commerce Across Asia: Trends and Developments 2014.” In this issue, we provide a comprehensive overview of e-commerce trends across the Asia-Pacific region with a focus on developing markets in Southeast Asia. In addition to analyzing macro-level economic and development indicators that signal the potential for region-wide growth, we explore several rapidly growing markets in-depth while highlighting opportunities for investment in each.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

China Further Promotes E-Commerce Development

Shanghai FTZ Launches Cross-Border E-Commerce Platform

China Offers Preferential Tax Treatment to Exports by E-Commerce Retail Enterprises

Vietnam Online – Understanding Vietnam’s E-commerce Market

DIPP to Push for Higher FDI Cap in E-Commerce

E-Commerce on the Rise in India

- Previous Article Philippines Destined to be Asia’s Next Tech Tiger?

- Next Article Cambodia-Malaysia Trade Grows Nearly 20 Percent in First Quarter of 2014