The Cost of Business in Malaysia Compared With China

By Chris Devonshire-Ellis

By Chris Devonshire-Ellis

Partner, Dezan Shira & Associates

Part Four in our series comparing ASEAN nation business costs with China

Malaysia is one of the ASEAN tigers and enjoys a good standard of trade and political relations with China. Relatively good infrastructure, especially around the Kuala Lumpur region, and a savvy political will to upgrade ports and rail and invest in hi-tech capabilities has made the country a magnet for large volumes of foreign investment, including from China.

Strategically well placed in Southeast Asia with both west and east coasts, its proximity to the regional hub of Singapore also makes Malaysia an attractive base. With KL just an hour’s flight from Singapore, it is now attracting back office facilities away from the city state. China is Malaysia’s largest trade partner, with bilateral trade having broken the US$100 billion level last year, having increased by nearly 25 percent per annum.

Elsewhere, Malaysia enjoys good trade relations with the following countries:

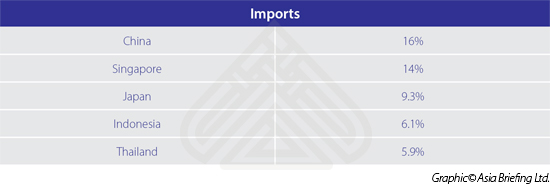

In terms of trade, the top five exports from Malaysia are refined petroleum (10.0%), petroleum gas (8.4%), palm oil (6.7%), integrated circuits (5.6%) and computers (5.1%). Malaysia’s place in global supply chains is shown by the reappearance of some of its top exports in its top five imports: integrated circuits (9.7%), refined petroleum (9.0%), crude petroleum (4.4%), office machine parts (2.0%) and planes, helicopters and/or spacecraft (1.9%).

Malaysia has been active in signing Double Tax Treaties and has signed off numerous agreements with many countries, including China, as well as several EU countries and the United States. It also has a Free Trade Agreement with India.

RELATED: Wage Comparisons & Trade Flows Between China, ASEAN and India![]()

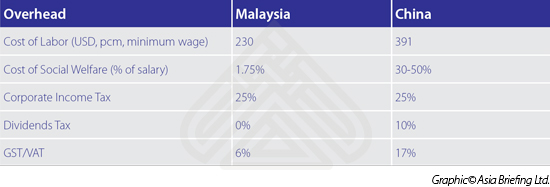

We can compare Malaysia and China in terms of average operational costs as follows:

Malaysian Foreign Investment Law

Generally, any person or foreigner can set up and operate a business in Malaysia. The requirement is that the firm or company must apply for registration from the Companies Commission of Malaysia (SSM).

![]() RELATED: The Cost of Business in Singapore Compared With China

RELATED: The Cost of Business in Singapore Compared With China

Malaysia allows foreign investors to use the following investment vehicles:

- Sole Proprietorship

- Owned by an individual operating as sole proprietor.

- Must register with the SSM under the Registration of Businesses Act 1956.

- Partnership

- Can be between two and twenty persons.

- Must register with the SSM under the Registration of Businesses Act 1956.

- Partners are both jointly and severally liable for the debts and obligations of the partnership should its assets be insufficient.

- Limited & Unlimited Liability Companies

A locally incorporated company or a foreign company must be registered with the SSM under the provisions of the Companies Act (CA) 1965, which governs all companies in Malaysia, in order to engage in any business activity. There are three types of company structures that can be incorporated under CA 1965:

- Company limited by shares

- A company formed on the principle that the members’ liability is limited by the Memorandum of Association to the amount, if any, unpaid on the shares taken up by them.

- Company limited by guarantee

- The liability of the members is limited by the Memorandum and Articles of Association to the amount which the members have undertaken to contribute to the assets of the company in the event the company is wound up.

- Unlimited company

- A company formed on the principle of having no limit placed on the liability of its members

The most common company structure in Malaysia is a company limited by shares. Such limited companies may be incorporated either as a Private Limited Company (identified through the words “Sendirian Berhad” or “Sdn Bhd” as part of the company’s name) or a Public Limited Company (identified through the words “Berhad” or “Bhd” as part of the company’s name).

![]() RELATED: The Cost of Business in the Philippines Compared With China

RELATED: The Cost of Business in the Philippines Compared With China

A company having a share capital may be incorporated as a private company if its Memorandum and Articles of Association:

- Restrict the right to transfer shares.

- Limit the number of members to 50, excluding employees in the employ of the company or its subsidiary and certain former employees of the company or its subsidiary.

- Prohibit any invitation to the public to subscribe for its shares and debentures.

- Prohibit any invitation to the public to deposit money with the company for fixed periods of payable at call, whether interest-bearing or interest-free.

A public company can be formed or, alternatively, a private company can be converted into a public company subject to Section 26 of CA 1965. Such a company can offer shares to the public provided:

- It has registered a prospectus with the Securities Commission.

- It has lodged a copy of the prospectus with the SSM on or before the date of its issue.

A public company can apply to have its shares quoted on the Bursa Malaysia subject to compliance with the requirements laid down by the exchange. Any subsequent issue of securities (e.g. issue by way of rights or bonus, or issue arising from an acquisition, etc.) requires the approval of the Securities Commission.

Additional requirements

Special licenses or approval must first be obtained from the respective authorities for certain businesses such as banks, insurance companies, share broking companies, professional firms, investment corporations, and manufacturing corporations before registration may be made to the SSM. The other respective approval authorities include:

- Ministry of Finance (MOF)

- Ministry of International Trade & Industry (MITI)

- Ministry of Domestic Trade & Consumer Affairs (MDTCA)

- Malaysia Industrial Development Authority (MIDA)

- Economic Planning Unit of the Prime Minister’s Department

Malaysia’s Industrial Coordination Act 1975 (ICA) requires manufacturing companies with shareholders’ funds of RM2.5 million and above, or engaging 75 or more full-time paid employees, to apply for a manufacturing license from the Ministry of International Trade and Industry’s (MITI) Malaysian Investment Development Authority (MIDA).

![]() RELATED: The Cost of Business in Thailand Compared With China

RELATED: The Cost of Business in Thailand Compared With China

Malaysia’s approval guidelines for industrial projects are based on the Capital Investment Per Employee (C/E) Ratio. Projects with a C/E Ratio of less than RM55,000 are categorized as labor-intensive and thus will not qualify for a manufacturing license or for tax incentives. Nevertheless, a project will be exempted from the above guidelines if it fulfills one of the following criteria:

- The value-added is 30 percent or more.

- The Managerial, Technical and Supervisory (MTS) Index is 15 percent or more.

- The project undertakes promoted activities or manufactures products as listed in the List of Promoted Activities and Products – High Technology Companies.

- Existing companies (formerly exempted) applying for a manufacturing license.

Professional Resources

Malaysia has established numerous free trade and special economic zones around its coasts including joint ventures with both Singapore and China. These are useful structures when considering an export manufacturing base in the country as they can attract tax incentives as well as alleviate the need to budget for VAT cashflow requirements. English is widely spoken in the country and it has generally excellent road, rail, and port facilities.

Malaysia has a reasonable amount of flexibility within its financial sector, however the ringgit is not fully convertible meaning some planning needs to go into getting money into and out of the country. There are numerous Asian and International banks operating in the country. A full list can be seen here.

Summary

Malaysia has been attracting a lot of outbound investment from companies in China as it offers a relatively high level of infrastructure and generally good employee skills. This makes it a sound launchpad for manufacturing goods to resell onto the ASEAN market, back to China, as well as to the international markets in Europe and North America and is therefore one of the few Asian countries able to realistically provide scope for all three. With a significant Chinese-speaking population, the country has cultural links with Chinese communities in the region, yet offers in contrast a reasonable climate and pollution free environment superior to much of China. With these assets in hand Malaysia looks set to continue its upwards trajectory and can be expected to boom and provide a high quality alternative to China manufacturing.

|

Links to the other articles in this series are as follows: |

||||||||||

|

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates. The practice has been operational in Asia since 1992 and assists foreign investors establish and maintain their operations throughout China, ASEAN and India. The firm possesses 28 Asian offices with a staff of 800, and has an Alliance office in Kuala Lumpur. Please contact the firm at malaysia@dezshira.com or visit https://www.dezshira.com. Please also look out for our Malaysia Briefing Group on Linked In for additional updates. Chris can be followed on Twitter at @CDE_Asia. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

- Previous Article ASEAN Regulatory Brief: Work Permits, Tax Filing, Rates and Incentives

- Next Article The Cost of Business in Myanmar Compared With China