Implementing Industry 4.0 in Singapore’s Manufacturing Sector

Industry 4.0 will impact operational processes and technologies used in Singapore’s manufacturing sector. We discuss the opportunities in key sub-sectors – electronics and semiconductor manufacturing, additive manufacturing (3D printing), medical devices, and pharmaceuticals and biomedical.

Industry 4.0 will impact operational processes and technologies used in Singapore’s manufacturing sector. This includes everything from automation and the application of the Internet of Things (IoT) to robotics and 3D printing. Manufacturers that can embrace Industry 4.0 stand to benefit from higher efficiency, cost savings, and a boost to bottom line growth. We explore key sub-sectors within Singapore’s manufacturing sector that can implement or have already implemented Industry 4.0 practices.

Industry 4.0 opportunities in key manufacturing sub-sectors

Electronics and semiconductor manufacturing

Electronics manufacturing is the bedrock of Singapore’s manufacturing sector, contributing to approximately eight percent of the GDP and 20 percent of total manufacturing jobs. From its modest beginning as the only TV assembly plant in Southeast Asia, Singapore has become a vital manufacturing hub for higher value-added electronic components.

The global electronics industry is projected to grow to US$3.3 trillion in 2030 from the US$2.2 trillion recorded in 2020. This growth will be driven by artificial intelligence (AI), 5G, automation, and the electrification of automobiles, among others. These applications will increase demand for microchips and in-turn, semiconductors – an industry with the potential to become a high-growth area for Singapore.

The country’s semiconductor industry is, in fact, one of the most diverse in the region, attracting global players like United Microelectronics Corporation and Siltronic AG, and contributing to seven percent of GDP. This makes the sub-sector a fundamental contributor to Singapore’s electronics manufacturing output. Further, the city-state accounts for approximately 11 percent of the global semiconductor market share and manufactures one-fifth of the global semiconductor equipment.

Through Industry 4.0, Singapore’s semiconductor producers can aim to transform their production lines into fully automated smart factories. Such factories can use machine vision algorithms to

conduct automatic quality control and relieve constraints on the available workforce, as well as use analytical software to account the cost of raw materials and components, resulting in better

business intelligence for product pricing.

Additive manufacturing

Additive manufacturing plays an essential role in meeting some of the important requirements of Industry 4.0. Commonly known as 3D printing, additive manufacturing simplifies the production

process, particularly for the assembly of products. As a result, 3D printing offers efficient solutions to facilitate personalized manufacturing and ‘intelligent production’.

In the Industry 4.0 era, the application of 3D printing reduces waste products and overall production costs since only the 3D data package of the product is required to produce a prototype. The inherent freedom of design allows engineers to create new geometric figures and manufacture parts with advanced features.

Companies like Airbus are using this technology to design aircraft components that are lighter and more efficient, and Adidas and Nike are producing lightweight, high-performance shoes that would have not been possible using conventional methods. Further, doctors are using 3D models to help design diagnostic and surgical tools.

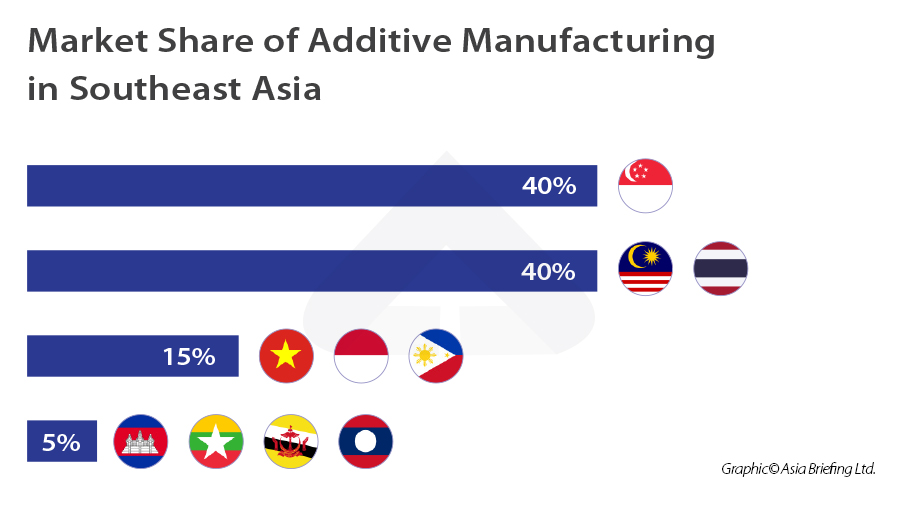

Within ASEAN, Singapore has a 40 percent market share of the additive manufacturing market, followed by Malaysia and Thailand with the next 40 percent. This industry is a vital enabler for Singapore to strengthen its global, advanced manufacturing foothold.

The Singapore government has established the National Additive Manufacturing Innovation Cluster (NAMIC), which aims to accelerate the adoption of additive manufacturing technologies in local industries, enabling them to operate in high value-added manufacturing fields. Additive manufacturing is expected to generate US$100 billion in economic value by 2025 in Southeast Asia.

Medical devices

The use of Industry 4.0 technology in the healthcare industry can deliver better care to patients. For example, AI can screen enormous amounts of data to recognize specific medical conditions that human diagnosis could easily miss. Moreover, AI tools can assist in running hospitals more efficiently, such as by identifying how staff and equipment can be better utilized.

Singapore’s medical devices industry is expected to be worth US$1.3 billion by 2023 due to increasing government spending, an ageing local population, as well as demand from the region. More than 60 multinational medical technology (medtech) companies are leveraging the country’s strong engineering capabilities and high-quality assurance to manufacture high-value products, ranging from life science instruments to contact lenses.

In addition, some 60 percent of the world’s microarrays and one-third of the world’s mass spectrometers are manufactured in Singapore. Investors are attracted by Singapore’s strong base for research and innovation that help medtech firms in designing new business models in healthcare, such as the use of big data to provide better patient-centric care. This, in turn, provides medtech companies with the capabilities to export their products or services to go-to-markets in the Asia Pacific.

Pharmaceutical and biomedical sectors

The global pharmaceutical industry has already begun implementing Industry 4.0 practices with many pharmaceutical manufacturers switching from batch manufacturing to continuous manufacturing.

Batch manufacturing is a lengthy process. After each step in the process, production is usually stopped to check for quality. During these ‘hold times’, the material is often stored in containers or even shipped to other facilities to complete the process. This increases the risk of defects and error as well as the lead time. However, under continuous manufacturing, the material is moved from end-to-end on a single, uninterrupted line, thus eliminating the hold times and shortens production times from months to days.

Singapore’s pharmaceutical and biomedical sectors are fast-becoming leading drivers of economic growth, showcasing both improved healthcare and manufacturing capabilities. The country’s deep base of skilled talents, probusiness environment, advanced infrastructure, and thriving research and development landscape has attracted some of the largest pharma firms in the world. This has resulted in Singapore being one of the few countries able to export more pharmaceutical products (approx. US$369 billion in 2020) than it imports (US$8.92 billion in 2020).

There are currently more than 50 manufacturing facilities in the country, with eight of the world’s 10 largest pharmaceutical firms owning plants in Singapore. Some of the major players include

Abbott, GlaxoSmithKline, Novartis, and Pfizer, who account for more than 40 percent of Singapore’s regional market. German biotechnology company BioNTech, who developed the COVID-19 vaccine —BNT162b2 — with American pharmaceutical firm Pfizer, has established its Asia-Pacific regional headquarters in Singapore, where it will also set up an mRNA manufacturing facility.

The company’s manufacturing plant is expected to be operational by 2023 and will produce several hundreds of millions of mRNA vaccines. More importantly, it will help build a rapid-response

production capability to address the threat of future pandemic threats in the Asia-Pacific region and open the company to a dynamic marketplace with a population of 655 million.

In the last 30 years, there have been no major observations by regulators like the US Food and Drug Administration (FDA) that regularly audit manufacturing facilities, which speaks to the quality of Singapore’s infrastructure and workforce.

Ready-built facilities, such as the JTC Space @ Tuas Biomedical Park (TBP), provide laboratory space that can be out-fitted for single-use technology (SUT) manufacturing activities. SUTs allow pharma companies to set up their manufacturing facilities quickly at reduced costs and allows the company to produce multiple products in a single suite

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article How Singapore is Poised to Take Advantage of Industry 4.0

- Next Article Philippines to Prepare Green Lane for Strategic Investments