Indonesia Online: A Guide to E-commerce

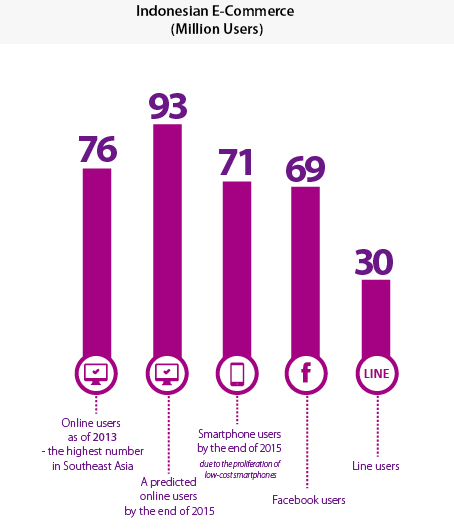

While currently, e-commerce only accounts for less than one percent (worth ~US$2 billion per year) of Indonesian retail spending, analysts believe that the country’s fast growing middle class and proliferation of smartphones will soon raise that share to eight percent (worth US$8 billion) in just a few years. If that scenario were to happen, then Indonesia’s e-commerce market would be the largest in Southeast Asia.

Although accurate predictions are hard to make (analyst estimates range significantly), there is general agreement that Indonesia’s e-commerce industry should see strong growth over the next few years. The market numbers certainly exist – the country has the fourth largest population in the world. Indonesians are increasingly tech savvy as well, Jakarta is known as the “Twitter capital” of the world, due to the massive level of tweets its citizens emit each year.

Currently, e-commerce sales in Indonesia are admittedly somewhat low, but sales are expected to triple by 2016. Like most countries, the top category for online shopping is clothing and apparel. In 2014, around 60 percent of online shoppers bought items in this category. Interestingly, 27 percent of all e-commerce transactions occurred via social media.

However, there is certainly much to overcome before Indonesia, and investors, can reach this sunny outcome – 11 percent of the country still lives in poverty and another quarter of the country is living near poverty levels. Internet penetration levels are still low (with high-speed internet lacking in many parts of the country), as are levels of disposable income.

In a counterpoint to this dispiriting news, according to an analysis conducted by the Boston Consulting Group late last year, 74 million Indonesians live in households that spend more than US$200 per month – this number is predicted to grow to 141 million by 2020. Furthermore, according to SingPost, a global logistics firm, there will be 20 percent year on year growth in internet users through the year 2016.

An additional factor contributing to the growth potential of e-commerce in Indonesia, is the fact that more and more people are becoming too busy to shop in traditional stores and do not want the headache associated with navigating the notoriously busy roads in order to reach the stores, instead preferring the products to be brought to their chosen location.

Who is already there?

Companies like Lazada, which is known as “the Amazon of Southeast Asia”, are already operating within Indonesia. Lazada, which has been in the country since 2013, became the largest business to consumer site in Indonesia during 2014 (taking the top spot from Amazon). The company reportedly averages around 6.5 million views a months. Maximilian Bittner, chief executive of Lazada, has stated that he believes “Indonesia is predestined for a really massive explosion in e-commerce.” According to Lazada, Indonesians spend on average 181 minutes on their smartphones a day – the longest time in the world.

Other sites operating in the country include Alibaba (with 3.9 million views/month) and eBay (with 2.2 million views/month). It is unclear if Amazon has any future plans to invest into Indonesia with a physical presence – the company tending to prefer a light footprint for its operations in much of Asia.

![]() RELATED: Vietnam Online – Understanding Vietnam’s E-commerce Market

RELATED: Vietnam Online – Understanding Vietnam’s E-commerce Market

Tokopedia, a local company, is one of Indonesia’s top consumer to consumer marketplaces; it has reportedly received over US$100 million in funding from venture capitalist firms Softbank and Sequoia Capital. Many are hopeful that this sort of large cash injection will spur further investment into other e-commerce businesses in Indonesia. Said Tokopedia CEO and co-founder William Tanuwijaya, “If we can convince and carry the level of the company to match what the investors expect, it will provide them with the confidence to put money into other [local] startups.”

Most of the e-commerce companies operating in Indonesia make strategic use of mobile apps for smartphones, since these are the primary means of accessing the internet for most Indonesians. Smartphones are becoming increasingly widespread and affordable due to a high level of competition between mobile companies in the country, which is driving prices down. Additionally, e-commerce companies are finding that they are forced to implement cash-on-delivery payment systems because of the low number of people who have credit cards and/or bank accounts.

Control, alt, delete?

While the future of e-commerce in Indonesia certainly looks bright, it is important not to look at the country through rose colored glasses, there are a number of significant roadblocks that businesses will have to overcome in order to be successful operating within the country.

One possible warning sign about the potential of the Indonesian e-commerce market is that less than half of the country’s internet users spend three or more hours online per day. The three hour mark is thought to represent a significant indicator in the potential of online sales. For example, while still a small market, 62 percent of internet users in Vietnam average three or more hours per day. Part of the problem stems from Indonesia’s poor internet quality, according to the head of Rakuten Indonesia, this drives people to conduct their online shopping while at work (Rakuten reports its peak shopping time at 11am) since this is the one place where they have access to reasonably reliable internet.

![]() RELATED: Jumpstarting Tech Development and Startups in Vietnam

RELATED: Jumpstarting Tech Development and Startups in Vietnam

Another problem that companies must overcome if they wish to operate in the e-commerce space in Indonesia is finding a way to deal with the country’s poor shipping network. As a result, companies like Lazada have essentially created their own private delivery systems by hiring hundreds of motorbike and truck drivers to deliver their packages. Additionally, due to poor roads, unclear addresses, and a lack of good maps, it is often difficult to actually physically deliver the packages.

An additional area that companies must work on is the lack of trust that many people still have with regards to buying products online. This is an issue that e-commerce companies have had to grapple with throughout Southeast Asia. The populace worries that they will not receive the products that they have ordered, that they might lose their money, or have their information stolen. It is thus incumbent upon companies operating in the region to be open and honest about their policies and to ensure that they provide a high level of customer service.

The use of a system, such as the one used by Alibaba, where the company hold the customer’s money in an escrow account until both sides have agreed that they are satisfied with the deal, and then releasing the money to the seller, is a system that can go a long way to reducing customer distrust. Another option, although logistically more complicated, is cash on delivery.

A number of companies have arisen in order to fill the vacuum in the epayments space, these include Doku and Veritrans. In 2014, Doku processed US$520 million in transactions, a whopping 30 percent increase over 2013.

In or out?

Many companies and investors are increasingly viewing Indonesia as on the cusp of a tipping point vis-à-vis the country’s e-commerce business potential. For those eager to get in on the ground floor, now would seem to be the time to begin exploring potential strategies for entering the online market. The country is lacking in a range of internet and online services that innovative companies can carve out a market niche in. Certainly, the full pay off on any investment is still a few years away, but companies that do not jump into the Indonesian market now, risk missing out on the explosive early growth that this Southeast Asian country holds within it.

To learn more about the e-commerce investment opportunities available for your business, or to receive a personalized report on Indonesia, please contact Asia Briefing at: editor@asiabriefing.com

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2014 Asia Tax Comparator

The 2014 Asia Tax Comparator

In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.

- Previous Article Singapore-Vietnam in 2015: Trade and Investment Partners

- Next Article Business Optimism in Singapore Drops Again – Time to Worry?