Indonesia’s Employment Regulation: Practical Guide for Employers

A comprehensive guide on Indonesia’s employment regulation covering contracts, wages, working hours, foreign workers, and termination procedures.

Indonesia’s employment regulation

Conditions for hiring in Indonesia is primarily governed by the Manpower Act (Law No. 13 of 2003), which provides a comprehensive framework for labor relations. This law covers a wide range of issues, including working conditions, employment contracts, wages, working hours, and occupational health and safety. Understanding the Manpower Act is crucial for any employer operating in Indonesia, as it outlines the fundamental rights and obligations of both employers and employees.

Additionally, the Omnibus Law on Job Creation (Law No. 11 of 2020) revoked by Government Regulation in place of Law No. 2 of 2022 on Job Creation and further stipulated under Government Regulation 6 of 2023, introduced significant changes to various labor regulations, aiming to improve the business climate and attract investment.

Employment contracts

The Indonesian government sets minimum wage levels, which vary by region and sector. Employers must ensure that their wage structures comply with these regulations. In addition to wages, employees are entitled to various benefits, including annual leave, maternity leave, sick leave, and religious holiday allowances. The law also mandates specific working hours, with a standard workweek consisting of 40 hours and provisions for overtime compensation.

Types of employment contracts for local employees

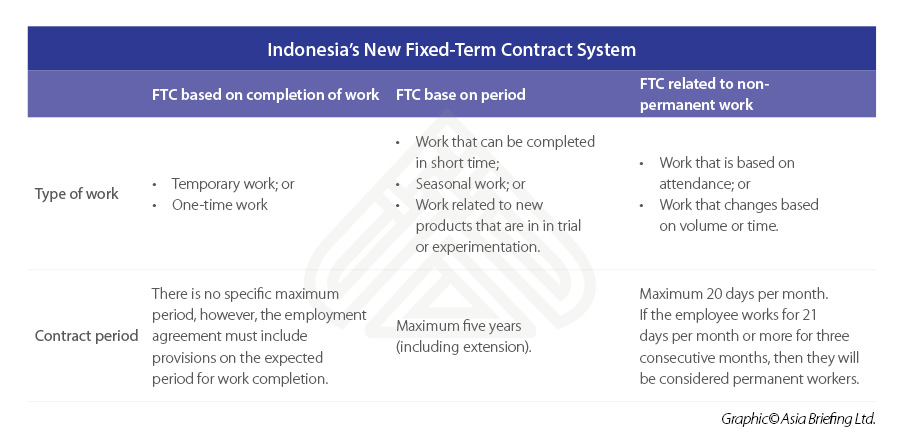

The government recognizes three types of fixed-term contracts (FTC):

- FTC based on the completion of work;

- FTC based on the period; and

- FTC related to non-permanent work.

GR 35/2021 states that all FTC types are for temporary work that can be completed within a set time period. Therefore, contract extensions cannot be for prolonged periods (5 years maximum in total). Failing to adhere to these rules will result in the employee being deemed on a permanent employment contract.

Compensation for FTC workers

Before the Omnibus Law, any party terminating the FTC was required to pay the other party compensation equivalent to the employee’s salary for the remaining time of the FTC. If an FTC expired naturally, then neither party would have to pay compensation.

This has changed with GR 35/2021, which now obligates the employer to pay compensation to the employee, even if the employee terminates the FTC prematurely.

The employers must pay compensation upon:

- The expiry of an FTC;

- Each extension of the FTC; and

- Early termination of the contract, irrespective of who terminates the contract.

How is it calculated?

Compensation is calculated using the following formula: When an FTC expires and is then extended, the compensation for the contract must be paid when the FTC expires. For any ongoing FTCs, the compensation payment will be calculated from November 2, 2020, the date from which the Omnibus Law came into effect. Further, foreign workers are not entitled to the aforementioned compensation.

Working hours

Normal working hours in Indonesia are 40 hours per week, which can be divided into eight hours per day for five working days or seven hours per day for six working days.

GR 35/2021 recognizes working hours of less than 40 hours per week if the company has the following characteristics:

- Undertake work that can be completed in less than 35 hours per week;

- Can implement flexible working hours; and

- Undertake work that can be completed outside a particular location.

Overtime

The regulation extends the overtime working hours to four hours per day and 18 hours per week, which does not apply to public holidays. GR 35/2021 requires that collective labor agreements, company regulations, or employment agreements specifically state which roles are entitled to overtime pay. If this is not expressed, then the employee will automatically be entitled to receive this payment.

These are:

- Employees that hold certain positions with responsibilities as thinkers, controllers, planners, executors, etc.;

- Workers whose working hours cannot be capped, such as those in managerial roles; and

- Workers that are paid high salaries.

Outsourcing

The new regulation clearly requires employers to include the provisions of transfer of rights protection in the contract in the event of a change in an outsourcing company. The outsourcing company must be a legal entity and comply with the business license it was issued by the central government.

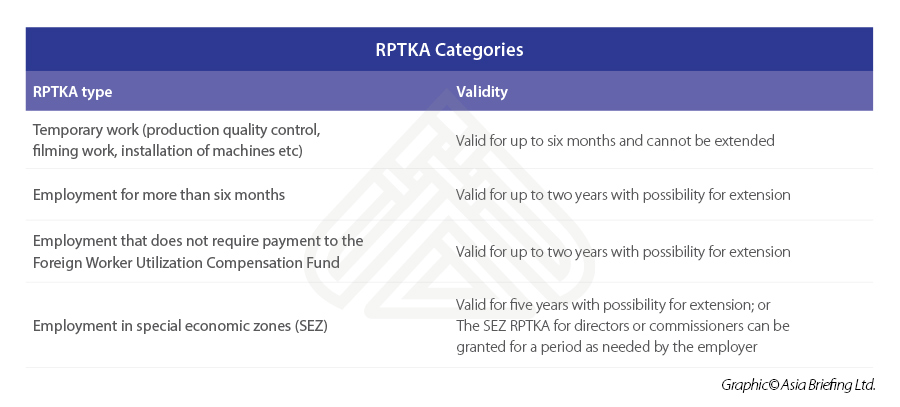

Foreign worker utilization plan

Employers hiring foreign workers must prepare a Foreign Worker Utilization Plan (Rencana Penggunaan Tenaga Kerja Asing (RPTKA)) — a document that details the specific work, position, and length of employment the foreign employee will undertake in Indonesia. The RPTKA now also serves as the basis for the Ministry of Manpower (MOM) to grant visas and stay permits.

What is the process of hiring foreign workers in Indonesia?

It is the responsibility of the local company to apply for the RPTKA, which can be done through the online portal, under the Ministry of Manpower. The application is addressed to the Director of Foreign Manpower Utilization Management (Direktur Pengendalian Penggunaan Tenaga Kerja Asing). However, if the application is for less than 50 foreign workers – then the application is addressed to the Director-General of Manpower Placement Guidance and Expansion of Work Opportunity (Direktur Jenderal Pembinaan Penempatan Tenaga Kerja dan Perluasan Kesempatan Kerja).

Who can apply?

According to Ministry of Manpower regulation MOM 8/2021, employers that can employ foreign workers include:

- Government institutions, international bodies, and foreign state representatives;

- Foreign trade representatives, foreign news agencies conducting activities in Indonesia, and foreign representative offices;

- Foreign private companies conducting business in Indonesia; • Legal entities such as private limited companies established in Indonesia;

- Social, religious, or cultural institutions;

- Entertainment management entities; and

- Other business entities that are allowed to employ foreign workers.

RPTKA assessment

Once submitted, the MOM will conduct a feasibility study to see if the employer and prospective employee meet all the requirements.

Employers are required to submit the following information:

- Identity of the employer;

- Reasons for utilizing a foreign worker;

- The position of the foreign worker within the company’s organization structure;

- Number of foreign workers being employed;

- Contract length of the foreign employee;

- The working location of the foreign employee;

- Proof of mandatory employment reporting by the employer; and

- Statement letter affirming the following:

- The designation of the Indonesian employee(s) assigned as a co-worker to the foreign employee;

- The Indonesian employee(s) who will receive training or education from the foreign employee following the position and qualifications of the foreign employee;

- The foreign worker returns to their home country once their work contract expires; and

- Plans to absorb Indonesian workers.

The results of this assessment will be issued in no more than two working days.

Personal information submission

The employer can submit the personal information and documents of the foreign worker after the RPTKA assessment or during the submission of the RPTKA documents. The personal information will be verified by the MOM within two working days.

RPTKA approval and payment

If the documents and information declared to the MOM are correct and complete, the MOM will issue a payment notification letter for the amount of US$100 to the Foreign Workers Compensation Fund (Dana Kompensasi Penggunaan Tenaga Kerja Asing or DKP- TKA). This amount is to be paid to the MOM every month for the duration of the foreign employee’s contract.

Once the employer has made the payment, the MOM will issue the RPTKA approval, and the data will be sent to the Ministry of Law and Human Rights, who will process the visa and stay permits. Payment of the DKP-TKA is waived for foreign state representatives, international bodies, religious institutions, social institutions, and certain positions in the education sector.

Annual reporting obligations

Employers must submit an annual report to the MOM that covers the scope of the foreign worker’s employment, the education or training facilitated to Indonesian co-workers, and the types of technology transfer implemented.

RPTKA exemptions

There are RPTKA exemptions for foreign workers who are members of the board of directors, members of the board of commissioners, diplomatic or consular staff, or are hired by the local employer in connection to emergency activities, vocational activities, or in connection to production activities of an Indonesian-based tech startup. Specifically, for tech-based startups and vocational training activities, the RPTKA exemption lasts for no more than three months, after which the company must apply for RPTKA approval. This application must be submitted at least two weeks before the expiration of the period of employment of the foreign worker, as stated in the foreign worker employment statement letter, which is issued in place of an RPTKA approval.

The MOM will issue the IMTA, and the immigration office will issue a limited-stay visa (VITAS). Upon arriving in Indonesia, the applicant must convert their VITAS into a limited stay permit Kartu Izin Tinggal Terbatas (KITAS).Additional requirements to obtain a VITAS

Once a foreigner has received sponsorship to work in Indonesia, they can apply for a limited stay visa (Visa Tinggal Terbatas or ‘VITAS’). The additional requirements to obtain a VITAS are:

- A letter detailing the applicant is of good standing from the embassy or consulate of the foreigner’s country of origin; and

- A health letter stating that the applicant is free from any contagious diseases.

After the VITAS is secured, their immigration status changes to a limited stay permit (ITAS), which requires an official stamp from an immigration office. Once the ITAS is secured, the foreign worker can receive a KITAS, which will permit them to work in Indonesia for up to 12 months. This can then be extended when the expiry date approaches.

Termination of employment

Government Regulation 35 of 2021 (GR 35/2021) sets the procedures to unilaterally terminate employment. The employer must first notify the employee in writing, setting out the reasons for termination, and the termination payments and entitlements at least 14 business days before the date of termination. If the employee has no objection to the termination, then the employer can notify the Ministry of Manpower of this notice.

If, however, the employee objects to the termination, they must provide, in writing, the reasons for this within seven business days from receiving the termination notice. Any disagreements related to termination should be discussed between the relevant parties to agree to mutual separation. If this fails, then the matter can be brought to the local employment office for mediation, and if this fails, to the Industrial Relations Court.

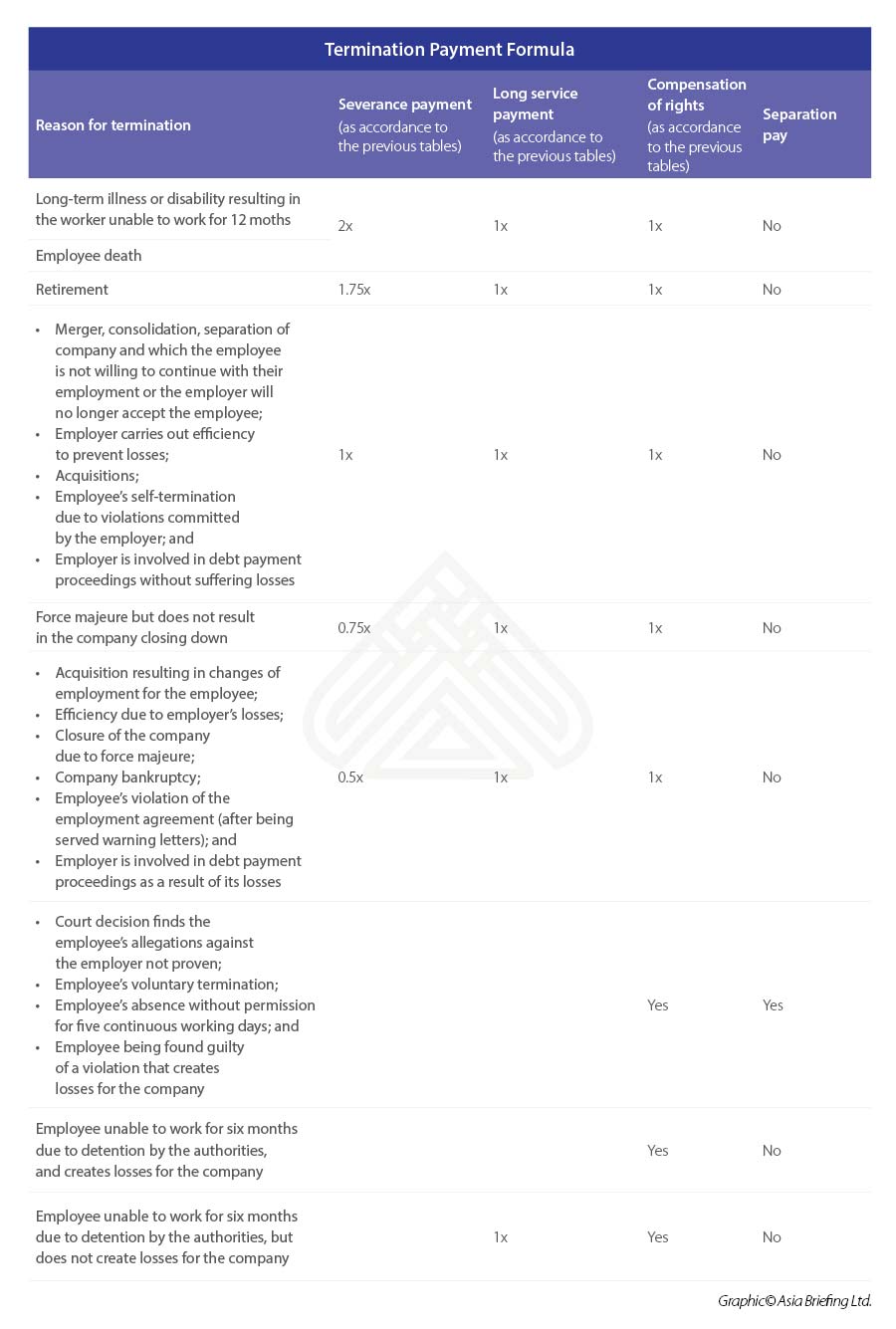

Termination payments

Terminated employees are entitled to termination payments and the amount varies depending on the length of employment of the employee. Termination payments are comprised of severance payments, long service pay, and compensation of rights. There is another component called separation pay, but this must be stipulated in the employment agreement.

Compensation pay refers to compensation for any untaken annual leaves and other costs incurred such as for relocation. Long service pay refers to a type of compensation given to employees based on the number of years they have worked at the company. An employee who has had their contract terminated may be eligible for the long service pay in addition to their severance pay.

Reg 35/2021 does provide changes to calculating termination pay for certain cases, such as merger or consolidation of the company resulting in the termination of the employee, or closure of the company due to mounting losses, among others.

About Us

ASEAN Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Jakarta, Indonesia; Singapore; Hanoi, Ho Chi Minh City, and Da Nang in Vietnam; besides our practices in China, Hong Kong SAR, India, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

Please contact us at asean@dezshira.com or visit our website at www.dezshira.com and for a complimentary subscription to ASEAN Briefing’s content products, please click here.