Vietnam’s New Minimum Wage Effective from July 1, 2024

The new minimum wage in Vietnam, effective July 1, 2024, will impact various social insurance items calculated based on the statutory pay rate. Employers in Vietnam are advised to pay attention to the cost impact of the statutory pay rate and the minimum regional wage.

On June 30, the Government issued Decree 73/2024/ND-CP regarding the new basic salary and Decree 74/2024/ND-CP concerning the new minimum salaries, both of which took effect from July 1, 2024.

As a result, the capped salaries used to calculate contributions for social insurance, health insurance, and unemployment insurance will increase accordingly.

Updates to the Vietnam minimum wage from July 1, 2024

Comments on the market update: Nguyen Vu Phuoc Hong, Manager of HR and Payroll at Dezan Shira & Associates Vietnam, notes that the change [in minimum wage] will impact multiple aspects that are calculated based on the statutory pay rate, including social insurance (SI), health insurance (HI), union fees, unemployment insurance (UI) (hereinafter “SHUI” to refer all four categories) and benefits from social insurance.

The maximum social insurance salary, health insurance salary, trade union fee, and unemployment insurance (UI) are going to increase on July 1, 2024.

Hong also calls businesses’ attention to the cost effect of the statutory pay rate and the minimum regional wage. If the employees sign a labor contract with a net salary instead of a gross salary, the cost of SHUI will only affect the company's costs, not the employee’s income. Therefore, along with the increase in SHUI contributions, employee benefits will also increase.

SHUI and trade union fee contributions

|

Items |

From July 1, 2023 to June 30, 2024 |

From July 1, 2024 |

Note |

|

The statutory pay rate |

VND 1,800,000 |

VND 2,340,000 |

All Vietnam |

|

The maximum social insurance salary |

VND 36,000,000 |

VND 46,800,000 |

The maximum SI salary is 20 times the statutory pay rate. |

|

The maximum health insurance salary |

VND 36,000,000 |

VND 46,800,000 |

The maximum HI salary is 20 times the statutory pay rate. |

|

The maximum trade union fees salary |

VND 36,000,000 |

VND 46,800,000 |

The maximum trade union fee salary is 20 times the statutory pay rate. |

|

The minimum regional wage |

|||

|

The maximum unemployment insurance salary - Region 1 |

VND 93,600,000 |

VND 99,200,000 |

The maximum UI salary is 20 times the regional wage |

|

The maximum unemployment insurance salary - Region 2 |

VND 83,200,000

|

VND 88,200,000

|

|

|

The maximum unemployment insurance salary - Region 3 |

VND 72,800,000

|

VND 77,200,000

|

|

|

The maximum unemployment insurance salary - Region 4 |

VND 65,000,000

|

VND 69,000,000

|

|

How to understand the regional minimum wage in Vietnam

The regional minimum wage in Vietnam represents the lowest wage level and serves as the basis for businesses to negotiate and pay wages to laborers. This amount applies to individuals working under employment contracts as stipulated by the Labor Code, including those working in enterprises, cooperatives, farms, households, individuals, and other Vietnamese organizations that employ staff under contracts, as well as foreign organizations and individuals in Vietnam that employ laborers.

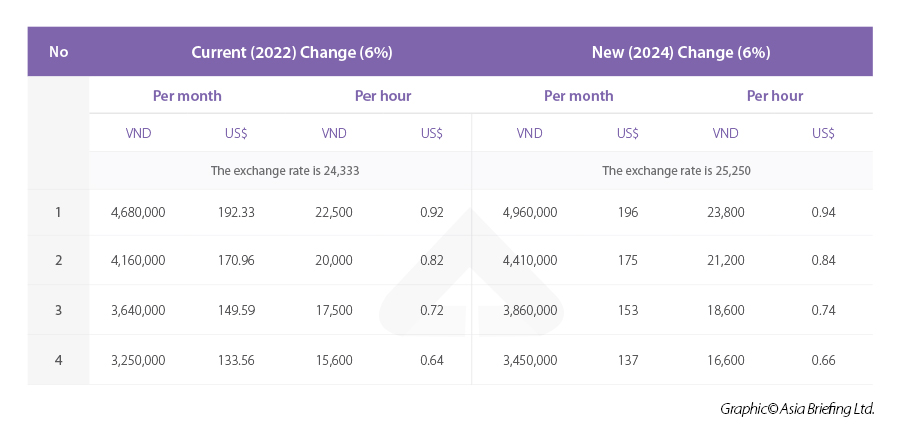

Vietnam's monthly minimum wages vary across four different regions, each determined by the living standards in those areas.

Region I covers various urban and rural districts of:

- Three direct-controlled municipalities of Hanoi, Ho Chi Minh City, and Hai Phong; and

- Quang Ninh, Hai Duong, Dong Nai, Binh Duong, Ba Ria – Vung Tau, and Long An provinces.

Region II covers:

- The remaining rural districts of the direct-controlled municipalities listed in Region I;

- Urban districts of Can Tho City;

- Urban and rural areas of Da Nang City; and

- Some urban and rural areas of many provinces.

Region III covers:

- The remaining provincial cities;

- Rural districts of Can Tho City; and

- Some rural areas of various provinces.

Region IV includes all of the remaining subregions.

Background

Vietnam announced last year that it will raise the minimum wage by 6 percent starting July 1, 2024. The Vietnam General Confederation of Labor had advocated for a 6.48 to 7.3 percent increase, while the Vietnam Chamber of Commerce and Industry suggested a 4.5 to 5 percent hike would be better for businesses, resulting in a compromise between the two proposals.

This increase will mark the first minimum wage adjustment since July 2022.

With inputs from Vu Nguyen Hanh.

(This article was originally published June 28, 2024. It was last updated August 12, 2024.)

This article first appeared on Vietnam Briefing, our sister platform.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.