The Variable Capital Company (VCC) is a versatile corporate structure designed to cater to the needs of collective investment schemes. This innovative structure allows multiple open-end and closed-end investment funds to be housed under a single corporate entity while maintaining distinct segregation between them. Mutual funds, known as open-end funds, continuously issue new shares to investors and retire them upon sale, unlike closed-end funds, which have a fixed number of shares traded on exchanges. Closed-end funds are often riskier as they frequently employ leverage, investing with borrowed money to enhance potential returns.

The VCC model aligns with global trends in establishing fund structures similar to Europe’s AIFMD, Hong Kong’s Open-End Fund Company, and Australia’s Corporate Collective Investment Vehicle. Previously, Singapore’s fund framework was less efficient and faced challenges in confidentiality and reporting.

Unique to this structure, shareholders in a VCC can profit from the VCC assets in line with the rights defined in its constitution. Notably, VCCs are not confined to distributing dividends solely from profits, and shareholders have the flexibility to redeem or sell their shares back to the VCC, facilitating an exit from their investment without the typical capital maintenance requirements.

VCC Singapore’s legal framework

As a significant development in Singapore's financial landscape, The VCC framework was established to strengthen the city-state's position as a premier fund management and domiciliation hub in Asia. Governed by the Variable Capital Companies Act and overseen by ACRA, all VCCs must be managed by a permissible fund manager. Additionally, VCCs fall under the purview of the Monetary Authority of Singapore (MAS) for anti-money laundering and countering the financing of terrorism compliance obligations.

VCCs can be used for a variety of investment funds, as mentioned in the table below:

|

Fund category |

Fund eligibility |

|||||||||||

|

|

Authorized |

Restricted |

Exempt |

|||||||||

|

Mutual funds |

Unit Trust/VCC |

Unit Trust/VCC |

Unit Trust/VCC |

|||||||||

|

Hedge funds |

- |

Unit Trust/Ltd. Partnership/Company/VCC |

Unit Trust/Ltd. Partnership/Company/VCC |

|||||||||

|

Private equity and real estate funds |

- |

Unit Trust/Ltd. Partnership/Company/VCC |

Unit Trust/Ltd. Partnership/Company/VCC |

|||||||||

Benefits of utilizing a VCC Entity in Singapore

VCCs are a sought-after structure for fund management in Singapore due to the following:

- Capital structure flexibility: VCCs provide an agile framework for capital allocation and distribution, enabling the issuance and redemption of shares without the complex procedural requirements associated with share capital adjustments—this feature streamlines fund managers' ability to handle investor subscriptions and redemptions.

- Legal and tax benefits: Leveraging Singapore's comprehensive network of tax treaties, VCCs are eligible for tax exemptions akin to those available to traditional fund structures under schemes like the Singapore Resident Fund Scheme or Enhanced-Tier Fund Scheme.

- Operational versatility: VCCs accommodate both open-ended and closed-ended fund strategies within a single entity. This flexibility particularly appeals to fund managers overseeing diverse funds with varying investment approaches.

- Asset protection: Each sub-fund operates as an independent legal entity in a VCC. This separation ensures that the assets and liabilities of one sub-fund do not impact another, offering a safeguard for investors and an advantage for managers handling funds with different risk profiles.

- Investor confidentiality: The VCC structure respects investor privacy, exempting the disclosure of shareholder information. This aspect is particularly valued by investors seeking discretion in their investment engagements.

- Regulatory support: The Monetary Authority of Singapore (MAS) actively endorses VCCs, providing incentives like a grant scheme to subsidize expenses related to VCC incorporation or re-domiciliation partially. This support further motivates fund managers to consider this structure.

- Global compatibility: Designed to align with international norms, the VCC framework is a competitive choice for global fund managers aiming to domicile funds in a reputable jurisdiction.

- Ease of formation and maintenance: VCCs can be established and maintained more swiftly and cost-effectively relative to analogous structures in other regions.

- Strategic advantage: Singapore's geographical positioning in Asia, with its status as a financial center, stable political climate, and proactive regulatory environment, enhances the appeal of VCCs to international investors.

These elements collectively establish VCCs as an attractive option for fund managers and investors seeking to capitalize on Singapore's solid regulatory infrastructure and conducive business landscape for fund domiciliation and management.

VCC requirements

VCC’s establishment requirements are as follows:

- The capital structure of a Variable Capital Company (VCC) is designed to mirror its net assets, offering significant flexibility in capital distribution and reduction.

- A VCC is required to appoint a minimum of one Singapore-based director for non-authorized schemes and a minimum of three directors for authorized schemes.

- A VCC must be managed by a fund manager who is either licensed or regulated in Singapore unless specific exemptions are applicable under current regulations.

- Variable Capital Companies are subject to the existing Securities and Futures Act (SFA) guidelines applicable to investment funds.

- It is mandatory for a VCC to have its registered office within Singapore and to appoint a company secretary based in Singapore.

- A VCC is obligated to undergo an audit conducted by a Singapore-registered auditor and to prepare its financial statements in accordance with International Financial Reporting Standards (IFRS), Singapore Financial Reporting Standards (FRS), or the US Generally Accepted Accounting Principles (US GAAP).

Setting Up a VCC in Singapore

Foreign corporate entities seeking to transfer their registration to Singapore through inward re-domiciliation must comply with the Variable Capital Companies (VCC) Act. This process allows these entities to become registered VCCs in Singapore without impacting their existing obligations, liabilities, properties, or rights.

The following conditions must be met to be eligible for transfer:

- Directors’ assurance: All directors must confirm that the entity fulfills the criteria outlined in sections 9(1)(a) and (b) of the Variable Capital Companies (Transfer of Registration) Regulations 2020.

- Legal Authorization: The entity must be legally permitted to transfer its incorporation according to the laws of its original jurisdiction.

- Compliance with Original Jurisdiction Laws: All legal requirements for transfer in the entity’s place of incorporation must be satisfied.

- Integrity of application: The application under section 134(1) of the VCC Act must not aim to defraud creditors and should be made in good faith.

- Additional criteria: The entity must not be under judicial management, liquidation, or undergoing winding-up processes.

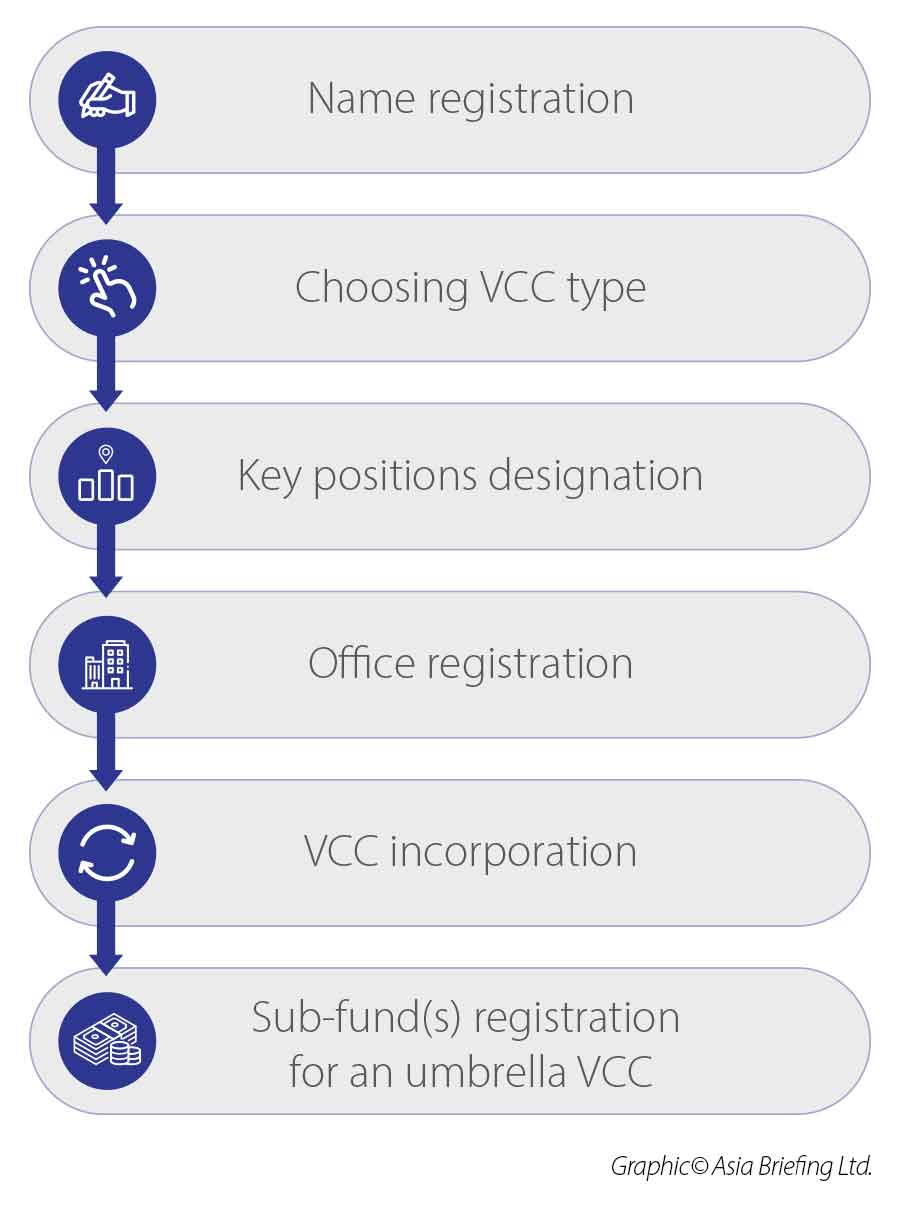

Application Process

Registering a VCC name

Choosing and registering a name for your Variable Capital Company (VCC) is a key initial step.

- Start by selecting a unique and appropriate name, ensuring it's not already taken, offensive, or restricted by the Minister for Finance. Check its availability on the Bizfile+ Search Directory.

- Register the chosen name via the VCC Portal for an SG$ 15 (US$11) fee.

- Once approved, the name is reserved for 120 days, within which you must incorporate your VCC. Be mindful that names may need additional review from relevant authorities, depending on their nature.

If necessary, you can withdraw a name application within the 120-day reservation period before completing the incorporation process through the 'Start a new VCC or Sub-fund' section on the VCC Portal.

Determining the VCC type

A Variable Capital Company (VCC) can be established either;

- As a standalone entity; or

- As an umbrella organization encompassing multiple sub-funds.

Under the umbrella framework, each of these sub-funds maintains its distinct portfolio of assets and liabilities.

Appointing Directors, Company Secretary, and Other Key Persons

Director

The director oversees the company's operations and makes impartial decisions that align with the VCC's best interests. Each VCC is required to have at least one director who resides in Singapore. This individual could be a Singapore citizen, a Permanent Resident, or a holder of an EntrePass or Employment Pass and must have a local residential address. Additionally, every VCC must appoint at least one director (potentially the same individual who is a resident of Singapore) who either qualifies as a Representative as per the VCC Act or is a director of the company's fund manager.

For VCCs encompassing Authorised Schemes, a minimum of three directors, including one independent director, is mandatory. An Authorised Scheme is a collective investment scheme established in Singapore and sanctioned by the Monetary Authority of Singapore (MAS) under the Securities and Futures Act (SFA).

To qualify as a VCC director, a candidate must fulfill the following criteria:

- Be at least 18 years of age;

- Possess full legal capacity;

- Be a Singapore Citizen, a Singapore Permanent Resident, or an EntrePass holder. Employment Pass (EP) holders may also serve as directors, provided they acquire a Letter of Consent (LOC) from the Ministry of Manpower (MOM) beforehand;

- Ensure to obtain consent from the relevant authority issuing their pass (such as MOM or the Immigration & Checkpoints Authority) before registering or assuming any official role (such as Director or Secretary);

- Not be banned from acting as a director of a VCC, for instance, due to undischarged bankruptcy.

Company Secretary

A Variable Capital Company (VCC) is required to appoint a secretary within six months of its incorporation who fulfills the following criteria:

- They should be a natural person, as opposed to a corporate entity.

- Their usual place of residence must be Singapore.

The role of the company secretary must not be left vacant for a period exceeding six months. Additionally, the company's sole director cannot simultaneously hold the position of the company secretary.

Fund Manager

A Permissible Fund Manager is defined as:

- A fund management company that is authorized and holds a Capital Markets Services License for fund management, as per the Securities and Futures Act (SFA).

- A fund management company registered under paragraph 5(1)(i) of the Second Schedule to the Securities and Futures (Licensing and Conduct of Business) Regulations.

- A financial institution that is exempt under sections 99(1)(a), (b), (c), or (d) of the SFA from holding a Capital Markets Services License for operating in fund management. This includes banks licensed under the Banking Act 1970, merchant banks approved under the MAS Act 1970, finance companies licensed under the Finance Companies Act 1967, and companies or cooperative societies licensed under the Insurance Act 1966.

It is essential to provide specific details of the Permissible Fund Manager. These details include the Unique Entity Number (UEN), full name, the principal business address, and the country of incorporation of the fund manager. Additionally, a formal declaration from the Permissible Fund Manager is required to confirm their agreement to act as the VCC's fund manager and attest to their compliance with one of the criteria above for a Permissible Fund Manager, as mandated in section 46(2) of the VCC Act.

Auditor

Each Variable Capital Company (VCC) is obligated to appoint an auditor within three months following its establishment or registration. It is important to note that the audit exemptions outlined in sections 205B and 205C of the Companies Act do not apply to VCCs.

Foreigners who seek to establish a VCC in Singapore

Foreign individuals interested in establishing a Variable Capital Company (VCC) in Singapore should adhere to the following guidelines:

- Secure the expertise of a certified filing agent, such as a legal, accounting, or corporate secretarial firm, to facilitate the submission of your application.

- Appoint a director who fulfills the criteria outlined in the previously mentioned section regarding Directors.

- Residency outside of Singapore is permitted. However, if you intend to manage the VCC's operations within Singapore, obtaining authorization from the Ministry of Manpower (MOM) is mandatory.

Registered office address and constitution

Incorporating a Variable Capital Company (VCC) in Singapore requires a registered office address, which serves as the official location for receiving communications and storing the VCC's records. This address must be operational during standard business hours, though it does not have to be the site of the VCC's actual business activities.

Additionally, incorporation demands the submission of a constitution, a critical legal document outlining the VCC's fundamental characteristics, governance rules, operational procedures, and the rights and responsibilities of directors, shareholders, and the company secretary. While this constitution is not publicly accessible, it must be presented to public authorities upon request.

Incorporating a new VCC

A Variable Capital Company (VCC) can be established through the following procedures:

- Interested parties may directly apply to incorporate a VCC through the dedicated VCC Portal, accessible at www.vcc.bizfile.gov.sg. This process involves submitting the necessary documents by a subscriber to the VCC's constitution.

- Alternatively, one may employ the expertise of a certified filing agent or a corporate service provider (CSP) to manage and submit the incorporation application.

The standard fee for the incorporation of a VCC is set at $8,000. The processing time for the incorporation application ranges from 14 to 60 days.

Registration of sub-fund(s) for an Umbrella VCC

Sub-funds can be established exclusively under the umbrella of Variable Capital Company (VCC). For the successful registration of a sub-fund, the following details are mandatory:

- The proposed name of the sub-fund.

- The date of the sub-fund's establishment.

If a VCC transitions from a non-umbrella structure to an umbrella format, it is imperative to update this change on the VCC Portal within 14 days

Tax implications for VCCs

A VCC is treated as a company and a single entity for tax purposes. This means that only one set of income tax returns is required to be filed with the Inland Revenue Authority of Singapore (IRAS).

Tax exemption provisions

- Income Tax Exemptions: Variable Capital Companies (VCCs) incorporated and residing in Singapore are eligible for tax exemptions on specified income from designated investments. These exemptions are under sections 13R and 13X of the Income Tax Act, relating to funds managed by a Singapore-based fund manager.

- Concessionary Tax Rate: VCCs managed by approved fund managers under the Financial Sector Incentive – Fund Management scheme will benefit from a concessionary tax rate of 10%.

|

Tax exemption requirements |

||

|

|

13O Resident Tax Exemption |

13U Enhanced-Tier Tax Exemption |

|

Tax residency |

The fund must be a Singapore tax resident |

The fund might be established in or outside of Singapore |

|

Fund manager requirements |

A CMS-licensed Singapore-based fund manager is required |

A CMS-licensed Singapore-based fund manager and 3 investment experts are required |

|

AUM |

Without restrictions |

A minimum fund size of S$50 Million (US$37.2 Million) is required |

|

Fund reporting requirement |

A minimum of S$200,000 (US$149,000) annual expenses |

A minimum of S$200,000 (US$149,000) in annual local business spending |

|

Fund administration requirement |

|

None required |

|

A Singapore fund administrator is required |

||

|

Other reporting requirements |

Annual MAS declaration and IRAS tax returns |

|

Stamp duty regulations

- Sub-fund transactions: Transactions between sub-funds within a single VCC are subject to stamp duty as though each sub-fund were a distinct legal entity. This includes transfers of shares in private limited companies or immovable property.

- Umbrella VCCs and sub-funds: Stamp duty regulations also apply to transactions between umbrella VCCs and their respective sub-funds.

Double taxation treaties

VCCs have access to Singapore’s extensive network of over 80 double-taxation treaties. They can apply for a certificate of residence from the Inland Revenue Authority of Singapore (IRAS). The certificate will include the name of the VCC and all sub-funds deriving income from foreign jurisdictions. However, the applicability of tax treaty benefits is contingent on the specifics of each treaty. Professional tax advice should be sought.

Goods and services tax implications

- Goods and services tax (GST) on inter-sub-fund supplies: The supply of goods and services between sub-funds within a VCC is treated as a transaction between separate entities, and GST is levied accordingly. Each sub-fund must independently assess its GST registration liability based on its taxable supplies.

- GST remission: The existing GST remission for funds is extended to incentivized VCCs, aligning their GST treatment with other qualifying entities.

Variable Capital Companies grant scheme

The Variable Capital Companies Grant Scheme (VCCGS), initially introduced on January 15, 2020, has been established in Singapore for three years according to Singapore’s Asset Management Survey Report 2022. There is a total of 969 VCCs incorporated or re-domiciled in Singapore for various use cases and funds. These umbrella or standalone VCCs, representing 1,955 sub-funds, are managed by 544 regulated fund management companies. By the second quarter of 2023, there will be 1000 registered VCCs, predominantly small to medium in asset under management (AUM).

Under the extended VCCGS, the Financial Sector Development Fund (FSDF) will co-fund 30 percent of qualifying expenses paid to Singapore service providers for work related to the process of incorporating or registering a VCC, with a maximum cap of S$30,000 (US$22,300) per application.

A VCC that receives a grant under the Extended VCCGS must operate for at least one year from its Registration Date and cannot be wound up during this period. If the VCC is wound up within this first year or if the Qualifying Fund Manager fails to inform the MAS within a week of the winding up, the MAS may reclaim the awarded grant.

Qualifying expenses table

|

Category |

Qualified items for funding |

Funding level (%) |

|

Legal services |

|

30% co-funding of stated qualified expenses, up to S$30,000 per VCC |

|

Tax services |

Tax advisors, fund administrators, corporate secretaries, law firms, or other Singapore-based service providers charge fees for tax advice related to the incorporation or registration of a VCC, including but not limited to tax opinions on the incorporation or registration of a VCC as well as any tax incentive applications**. |

|

|

Administration and compliance services |

|

|

|

*To be clear, work done related to the Qualifying Fund Manager's licensing is not covered. **Tax compliance issues and comments on the VCC's eligibility for Singapore double tax treaties with other jurisdictions may be covered by tax advice. Fees charged for interacting with IRAS or MAS on tax matters for incorporating or registering a VCC will also be covered. ***This includes works related to examining the Qualifying Fund Manager's existing compliance framework to accommodate/make adjustments for the Qualifying Fund Manager's management of the VCC. |

||

Eligibility for the Extended VCCGS is limited to first-time qualifying fund managers who have not previously established a VCC or re-domiciled a foreign corporate entity as a VCC. The scheme applies only to VCCs incorporated or registered between January 16, 2023, and January 15, 2025. It is important to note that the scheme stipulates a minimum operational period of one year from the registration date for awarded VCCs. If a VCC is wound up within the first year, the fund manager is obliged to promptly inform MAS, which may then retract the granted funds. This initiative underscores Singapore's commitment to enhancing its fund management and investment hub position.

Challenges and considerations

Establishing and managing a Variable Capital Company (VCC) in Singapore presents several challenges and considerations.

Complex regulatory framework

One of the primary hurdles is navigating the complex regulatory environment. VCCs are subject to the Variable Capital Companies Act. They must comply with the strict guidelines set by the Accounting and Corporate Regulatory Authority (ACRA) and the Monetary Authority of Singapore (MAS). This includes compliance with anti-money laundering and counter-terrorism financing obligations. Additionally, setting up a VCC requires adherence to specific criteria, such as appointing a Singapore-based director and a fund manager licensed or regulated in Singapore. The intricacies of these requirements necessitate a thorough understanding of Singapore’s legal and regulatory framework for investment funds.

Risk management and compliance

Risk management and compliance are also significant considerations for VCCs. Due to their unique structure, where multiple funds with different risk profiles can be housed under one entity, ensuring each sub-fund operates independently and does not impact the others is crucial. This requires robust risk management strategies and internal controls. VCCs must navigate tax implications, including income tax exemptions and concessionary tax rates, as well as GST implications on transactions between sub-funds. Compliance with stamp duty regulations for transactions within and between sub-funds adds another layer of complexity. Therefore, potential fund managers must be prepared to invest in legal and financial expertise to manage a VCC successfully in Singapore’s dynamic investment landscape.

Emerging trends

Singapore’s VCCs offer a dynamic and flexible landscape for diverse financial entities. Their broad appeal is evident in the following distribution of usage:

- 33% by Private Equity and Venture Capital Firms;

- 28% by External Asset Managers and Multi-Family Offices;

- 20% by Hedge Funds;

- 14% by Retail Funds; and,

- The remaining 5% encompasses various financial groups.

This diversity highlights the VCC’s adaptability and growing importance in Singapore’s financial sectors, meeting a wide range of investment strategies and client requirements.

In response to evolving market needs, The Monetary Authority of Singapore (MAS) is actively enhancing the VCC framework to increase its attractiveness across the funds sector. A key development is the anticipated VCC 2.0, which claims to address the evolving needs of fund participants. This upgrade, expected to be introduced between 2024 and 2025, will potentially include features that were not part of the original framework due to timing constraints.

One significant aspect under consideration is the ability of fund managers to convert existing funds, structured as companies or unit trusts, into VCCs. Additionally, MAS is exploring options to broaden the range of fund managers who can utilize the VCC structure, potentially including license-exempt managers like Single Family Offices (SFOs). This aligns with Singapore’s broader objective to create a versatile and adaptable legal entity suitable for various investment businesses, such as asset and wealth management sub-sectors, including real estate investment trusts, securitization, and insurance products, to cater to their ever-changing markets.