With its favorable taxation policies and strategic position within Southeast Asia, Singapore offers foreign investors competitive and unprecedented access to the Asian market. Businesses can enjoy over 80 double taxation avoidance agreements, significant tax deductions, and numerous free trade agreements with neighboring Asian nations, the EU, the US China and India.

In addition to its political and economic stability, the city-state stands as a prominent financial center within the ASEAN region.

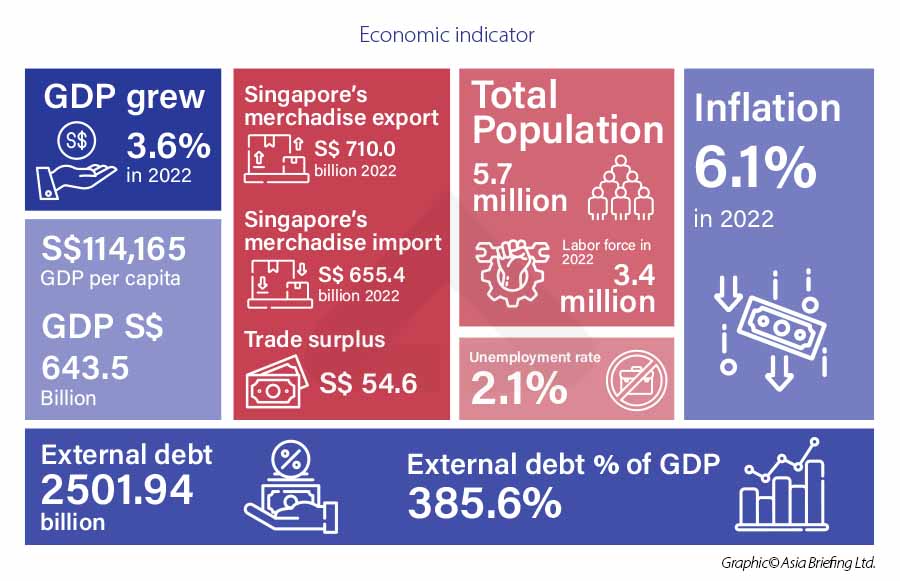

For investors with an international business scope, Singapore offers direct access to the global market. It’s highly developed infrastructure, stringent Intellectual Property protection, skilled and English-speaking workforce, and political stability make the city-state a global hub for businesses.

Geographically, the country is positioned amongst several thriving Southeast Asian economies, as well as the markets of China and India. The city-state has sought to mirror international business and trade standards, such as those presented by the World Trade Organization and the Organization for Economic Cooperation and Development.

Singapore’s economy and investment outlook

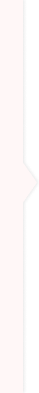

Singapore is one of the wealthiest countries in the world, reporting a GDP per capita of US$82,794 in 2022, the highest in Asia.

The city-state has maintained a steady economic growth over the past five years. Singapore reported a GDP of US$599 billion at the current market price in 2020, and is projected to trend around S$ 616.33 billion (US $449 billion) in 2023.

The largest industry sector is services, contributing close to 70 percent of the country’s total GDP in 2022. Despite this segment’s overall dominance, manufacturing remains the single largest industry sector, making up 21.5 percent and 21.6 percent of GDP in 2021 and 2022 respectively. Despite slowdowns in other pandemic-stricken industries, it saw a 7.3 percent growth in 2020 and a further acceleration in 2021 with 13.2 percent growth. This growth has been attributed to an expansion of biomedical manufacturing, electronics, and precision engineering clusters.

Thanks to its investor-friendly landscape, a favorable tax regime, and a highly-skilled domestic labor force, Singapore has long been a magnet for investors.

In 2022, Singapore experienced a 10% rise in its inward direct investment flows, reaching a total of $195 billion, according to Department of Statistics Singapore. The city state also boasts over 299,800 enterprises, with 20% of these majority foreign owned.

Manufacturing, including petrochemicals, electronics, machinery, and equipment, as well as financial, wholesale and retail trade, and business services, are among the most popular sectors for foreign investors.

Singapore as a hub and gateway to Southeast Asia

Singapore will continue to serve as a magnet for multinationals that want to use the country’s innovation-led economy and generous investment and tax regime as a springboard for Southeast Asia.

The country is well-placed to help investors navigate the challenges and opportunities presented by ASEAN markets: its efficient setup procedures, competitive tax environment, and integrated supply chains have helped Singapore surpass traditional holding locations in the region, such as Malaysia, and compete with well-established global investment destinations like Hong Kong.

There are numerous soft factors that make Singapore an ideal location for businesses to use as a regional headquarters or hub for expanding into the rest of ASEAN and Asia. The country’s use of English as its primary working language and favoring of international business policies and practices align it closely with international norms, yet the country maintains very close cultural and linguistic connections with the surrounding countries of ASEAN. As a result, the country’s labor talent pool is well equipped to act as intermediaries for doing business regionally throughout the rest of Asia, and globally.

Utilizing Singapore as a hub brings benefits that include a rapid entry into the region with streamlined business processes, comprehensive regional trade agreements, a competitive corporate tax landscape and tax incentives, being a strong pool for regional talent and hub for Intellectual Property protection strategies.

Trade overview

International trade represents an indispensable part of Singapore’s economy. The country’s Port of Singapore is one of the busiest and best-connected seaports in the world, with links to more than 600 ports in 120 countries. The port’s container throughput reached 37.3 million TEUs in 2022, handling a total of 578 million metric tons of cargo.

According to the Singapore Department of Statistics, the total volume of import-export reached US$964.5 billion in 2023, of which exports accounted for US$507.65 billion and imports US$ 456.85 billion. Machinery and transport equipment and chemicals represented the two largest commodity sections traded.

In 2022, Mainland China, Malaysia and the US were Singapore’s top trading partners.

Streamlined business processes

Singapore is consistently ranked among the top three economies in the World Bank’s Ease of Doing Business report.

The time and cost needed to set up in Singapore are relatively short. Foreign businesses that want to set up a business will need the assistance of a registered filing agent to submit the application on BizFile+, an electronic filing system that combines all the tax and business requirements on a single form.

The agent can help make payments through Bizfile; it costs US$254 (S$300) to register a company and US$11 (S$15) to register the company’s name. Most applications are processed within the same business day; however, the process could take 14 days to two months for applications that need to be reviewed by government agencies.

Bizfile is managed by the Accounting and Corporate Regulatory Authority (ACRA), which is the statutory body responsible for the monitoring of new companies.

The efficient and cost-effective nature of corporate establishment has resulted in more than 37,000 international companies and around 7,000 foreign multinationals operating from the country.

Singapore’s main working language is English, greatly facilitating communication between foreign businesses and their Singapore staff. Close cultural ties and a deep level of mutual understanding between Singaporeans and citizens of other ASEAN member countries can also significantly help with doing business in the region.

The transparent nature of Singapore’s business and legal regulations means most of the information a business needs are readily available online. This makes it much easier for overseas decision-makers to learn more about the market during the entry process.

Free trade and double tax agreements

Double taxation avoidance agreements

With its favorable taxation policies and strategic position within Southeast Asia, Singapore offers foreign investors competitive and unprecedented access to the Asian market. Businesses can enjoy nearly 100 double taxation agreements (DTAs) with significant tax deductions.

There are two types of DTA: comprehensive and limited. Comprehensive DTAs cover all income types and allow for the exchange of tax information, whereas limited DTAs cover income from shipping and air transport.

These DTAs also include treaties with ASEAN’s 10 member states – Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam – providing businesses with a greater competitive edge when entering this market.

Free trade agreements

Singapore has signed several free trade agreements (FTAs) with both neighboring Asian nations and major economic powers worldwide. The 26 FTAs currently in force consist of 15 bilateral and 11 regional FTAs. These provide Singapore with exclusive access to the largest combined free trade areas due to its agreements with ASEAN, which in turn has FTAs with China, Hong Kong, India, and the EU. The country is also negotiating new FTAs with the Pacific Alliance-Singapore and Eurasian Economic Union (EAEU).

Although some regional players maintain strong DTA and FTA networks, ASEAN member states have not matched Singapore’s extensive DTA and FTA network. Singapore’s ability to improve and expand its trade relations will allow the country to continue to be a default location for businesses looking to expand in Southeast Asia and neighboring regions.

Corporate tax landscape

Singapore’s favorable tax regime is internationally recognized for allowing entrepreneurs and companies to enjoy low tax rates and numerous types of tax relief – through incentives, comprehensive tax treaty networks, and exemptions from certain incomes.

Moreover, as the tax system operates on a territorial basis, companies are not taxed on most types of foreign-sourced incomes (such as from dividends or branch profits) that are remitted into Singapore, provided they pay tax in the source country with a rate of at least 15 percent. There is also no capital gains tax.

Singapore’s tax system is internationally recognized as efficient and competitive, which allows foreign investors to enjoy low tax rates and numerous tax incentives. The country operates a single-tier, territorial tax system, which means that foreign-sourced income would not face additional taxes. There is also no capital gains tax and there is no tax on dividends.

Singapore imposes corporate income tax (CIT) at a flat rate of 17 percent for both foreign and domestic companies, the lowest among all ASEAN member states. The country practices a single-tier corporate tax system, which means businesses pay CIT only on chargeable income (profits).

The low CIT rate has attracted a dynamic investment community to Singapore, comprising of more than 7,000 multinational firms, with more than half operating their Asia-Pacific business out of the country.

Tax incentives in Singapore

With one of the world’s most business-friendly tax regimes, Singapore has emerged as a major financial and economic hub in Asia. Investors are also drawn by the efficient and cost-effective process to incorporate a company and the country’s transparent legal system.

Applicants must fulfil rigorous requirements, which include committing to certain levels of investments, introducing leading-edge skills, technology, as well as contributing to the growth of research and development and innovation capabilities.

Singapore offers a range of tax incentives and schemes to encourage specific industries and activities. These incentives aim to foster economic growth and innovation. These incentives help reduce a company’s final corporate income tax rate, depending on the businesses eligibility for these, and include:

- Progressive Wage Credit Scheme

- Start-Up Tax Exemption Scheme

- Double Tax Deduction for Internationalization

- The 100 percent investment allowance scheme

- Startup SG Tech

- Enterprise Development Grant

- Enterprise Innovation Scheme; among others.

Additionally, there are industry-specific incentives for sectors such as biotechnology, maritime, and tourism. It is essential for businesses to understand the eligibility criteria, compliance requirements, and application procedures to fully benefit from these tax incentives and contribute to their long-term growth and competitiveness.

Overview of tax incentive schemes for foreign businesses

| Type of Incentives - Overview | ||

| Headquarter and internationalization incentives: | Tax exemption for start-up companies | 75% tax exemption on the first S$100k (US$73,6k) of normal chargeable income (income taxed at prevailing corporate tax rates), plus 50% tax exemption on next S$100k (US$73,6k) of normal chargeable income. |

| Partial tax exemption for companies | 75% tax exemption on the first S$10k (US$7,3k) of normal chargeable income, plus 50% tax exemption on the next S$190k (US$140k) of normal chargeable income. | |

| Common corporate tax relief measures to help reduce tax bills: | International headquarters award | Concessionary tax rate of 5% or 10% on income for businesses that commit to substantive headquarter activities, such as managing, coordinating, and controlling their regional operations from Singapore. |

| Merger and acquisition scheme | Provides the acquiring company an M&A allowance of 25% of the qualifying acquisition value capped overall at S$10m, S$40 million per assessment year, S$80k in stamp duty relief, and S$100k in double tax deduction transaction costs. | |

| Double Tax deduction for internationalization | Up to 200% tax deduction on expenses used for international expansion. | |

| Incentives for manufacturing and services activities: | Pioneer certificate incentive | Eligible companies may receive a concessionary tax rate of 5% or 10% on income derived from qualifying activities, limited to five years. |

| Investment allowance | Businesses can enjoy a tax exemption of up to 100 of fixed capital expenditure incurred. | |

| Incentives for finance and treasury activities: | Finance and treasury center | Finance and treasury activities derived income is taxed at a reduced rate of 8% (international treasury and fund management, investment and economic research analysis, and corporate finance and advisory services). |

| Financial sector incentive | Income derived from high-value-added financial sector activities such as equity market, derivatives market, and bond market transactions and services may be taxed at 5%, while other activities may qualify for a 13.5% tax rate. | |

| Financial sector technology and innovation scheme | Co-funding to develop financial technology (Fintech) that enhances Singapore’s banking industry, with support of up to 70% for qualifying costs such as IP rights, technical software, manpower skilling, and professional services, among others. | |

Global hub for Intellectual Property

With technology-driven innovation taking center stage in ASEAN, Singapore launched its latest 10-year blueprint to strengthen its position as an intellectual property (IP) hub. Named the Singapore IP Strategy (SIPS) 2030, the blueprint builds on the country’s existing IP environment but will see more coordinated intangible assets (IA) initiatives that stays ahead of technological advancements.

With the global IA value standing at US$65 trillion, SIPS 2030 aims to capture this huge market by working with enterprises to better translate the outputs of their research and development (R&D), including helping companies raise capital using their IA/IP, and getting their products or services to market and society.

The government is also providing holistic IA/IP training and education programs that are curated to meet the needs of industries, particularly those engaged in the digital sector.

A multitude of Singapore tax incentive relief measures are available to help businesses reduce their overall tax bills. Many of these incentives are for taxpayers involved in specified industries or sectors which are deemed essential to Singapore’s economy.

Applicants must generally carry out high-value activities in the country and will be required to commit to spending on local employment as well as certain levels of local business spending. Such factors include the capacity for the company to contribute to the growth of research and development (R&D), the potential for the business to create a spin-off to the rest of the economy, and introducing or anchoring leading-edge technology, activities, and skills in Singapore.

Why do foreign companies relocate to Singapore?

Singapore has long been a preeminent destination for setting up a regional headquarters and other foreign company structures to pursue business opportunities across ASEAN and Asia.

The country’s status as a preferred investment destination in Asia can be attributed to its legal and tax regimes – one of the most business and investor-friendly in the world – as well as its financial system, which is highly integrated with international financial markets.

This business landscape has enabled international investors to take advantage of Singapore’s access to some of the largest combined free trade areas through ASEAN, which include ASEAN-China, ASEAN-Hong Kong, and the ASEAN-India free trade agreements (FTAs).

To size up Singapore, or any country, as a potential destination for relocation, it is vital that foreign investors diligently research their options across many factors that are relevant to their situation. Such factors may include infrastructure, locations, talent availability, access to raw materials, incentives, supply chain partners and logistics, and others.

There are, however, a wide variety of factors that add up to make Singapore an ideal location for companies that want to do business in the region.

- All of the stated Top 10 Reasons to Invest in Singapore

- The country’s status as one of the most business and investor-friendly in the world – as well as its financial system, which is highly integrated with international financial markets. The country’s ongoing business reforms aiding foreign investors.

- Singapore’s corporate tax regime is one of the most attractive in Asia. Businesses can take advantage of the flat 17 percent corporate income tax rate for profits.

- The city-state’s strategic location makes it an extremely attractive place from which to springboard to some of the world’s most exciting and fastest-growing markets.

Summary: Top 10 Reasons to Invest in Singapore

|

1. |

Strategic Location |

Strategic location in Southeast Asia serves as a gateway to the Asia-Pacific region, providing easy access to major markets and facilitating international trade. |

|

2. |

Robust Economy |

With a strong and stable economy, Singapore offers a favorable investment climate. It boasts consistent GDP growth, a competitive business environment, and a well-developed financial sector. |

|

3. |

Ease of Doing Business |

Consistently ranks among the top countries in ease of doing business indices. Its efficient regulatory framework, transparent legal system, and supportive government policies make it an attractive destination for investors. |

|

4. |

Political Stability |

Enjoys political stability, with a reliable and transparent government that promotes business-friendly policies, upholds the rule of law, and provides a secure environment for investment. |

|

5. |

World-Class Infrastructure |

Boasts a world-class infrastructure, including modern transportation networks, advanced telecommunications systems, state-of-the-art industrial parks, and a well-connected airport, ensuring seamless connectivity and efficient operations. |

|

6. |

Talented Workforce |

A highly skilled and educated workforce, Singapore offers a talent pool equipped with expertise in various industries. The country's emphasis on education and training ensures a capable and adaptable workforce for businesses. |

|

7. |

Innovation and Technology Hub |

Established as a leading innovation and technology hub in Asia. It fosters research and development, supports startups, and provides access to cutting-edge technologies and innovation ecosystems. |

|

8. |

Financial Hub |

Renowned as a global financial hub offering a robust financial ecosystem, including a strong banking sector, capital markets, and an attractive tax framework. It provides access to capital and investment opportunities for businesses. |

|

9. |

Pro-Business Environment |

Known for its pro-business environment, characterized by low tax rates, efficient bureaucracy, intellectual property protection, and a strong commitment to free trade. These factors contribute to a conducive environment for business growth. |

|

10. |

Quality of Life |

Offers an exceptional quality of life, combining a safe and clean environment, excellent healthcare, world-class education, diverse cultural experiences, and a vibrant cosmopolitan lifestyle. This makes it an attractive destination for professionals and their families. |

FAQ: Singapore as a Regional Hub for Managing ASEAN Operations

Why has Singapore risen as a destination for the management of ASEAN expansion?

A myriad of factors contributed to making Singapore among the most attractive economies for investment in Asia. Effective administration of regional operations, integrated supply chain and minimized tax obligations allow Singapore to easily outcompete traditional holding locations such as Malaysia and fellow ASEAN members alike.

What is the benefit of routing investments through Singapore?

Companies operating in ASEAN might find that the cost of transferring profits back to their home country has increased in the absence of up-to-date DTAs.

By contrast, with many DTAs in place and 0 percent withholdings tax of its own on dividends, Singapore allows companies to remit profits from production centers at a lowered rate and then pass profits on to a parent company without further reduction.

What are the options for corporate establishment in Singapore?

Setting up a private limited establishment in Singapore is the most effect option for administering operations throughout ASEAN, whilst other options such as representative offices, publicly listed companies, and joint ventures are also available for foreign investors. The structure of the private limited establishment allows companies owners to maintain full control of regional operations but limit their liability in case of a conflict with its subsidiaries in third party states.

What steps are involved when establishing a company in Singapore?

Companies investing in Singapore must first appoint a filing agent and obtain approval for the company’s name, which should not be identical to a name that already exists. Secondly, a private limited company may be required to appoint a local director, company secretary, or auditors.

The next thing on the list is to set up a registered office, which may be outsourced if the company does not wish to rent an office space. However,this must be an address in Singapore.

They then must formally register with the Accounting and Corporate Regulatory Authority. While specific companies might face additional licensing or need to submit further documentation, all companies are subject to a variety of compliance requirements including holding the first annual meeting within 18 months of incorporation.